In the world of asset management, GSM Grosvenor stands out as one of the few alternative asset managers of its size ($75 billion AUM) demonstrating a consistent and meaningful commitment to identifying, cultivating, and investing in emerging and diverse investment managers. This past month marked the 20th anniversary of their flagship Consortium, a multi-day meeting in NYC of GPs, LPs, capital allocators, consultants, and service providers honoring Renae Griffin, Managing Director and Consortium founder. To describe it as a “conference” would not do the event justice. It was part investor master class, part research symposium, with a healthy dose of professional and motivational coaching (world tennis champion Billy Jean King enthusiastically hit tennis balls into to the crowd after talking gender equality, much to attendee’s jubilation), and well-orchestrated professional speed dating that would put a matchmaker to shame. The name Consortium truly did it justice.

In a time when most financial service companies will acknowledge the importance of investing more heavily in diverse sponsors, the events or initiatives they announce promoting this goal can often feel like superficial, albeit elaborate, virtue signals to placate their own investor base, employees, and the public at large. But as an attendee this year, I can attest that that this was not that. GSM illustrated very tangibly, both via statistics and first-hand accounts from successful managers who had received their funding, the magnitude of their commitment. This one went deeper than words.

Let’s start with the numbers. Since 2002, the firm has made over $12billion of investments to 130+ diverse managers. Nearly half of GSM’s private equity commitments were to diverse managers over the last three years. And they didn’t just ride the wave, investing after managers were fully-established. They’ve invested in 33 first-time funds, including Vistria, Clearlake, and Vista Partners, three minority-founded PE firms that now collectively manage over $175 billion in AUM. And two of the Consortium’s panelists and women of color, Tammy Jones, CEO of Basis Investment Group, and Jennifer McElyea, Managing Partner of Ethos, both received critical anchor investments from GSM to grow their respective firms.

This matters because historic under-investment in diverse sponsors is often framed by large asset managers as a talent problem (i.e., “we don’t know where to find them”) or returns problem (i.e., “they are too risky, or “their investments generate sub-par returns”). But the fact GSM has built a $75 billion AUM machine, not despite, but greatly aided by their approach of investing early and often in the most promising diverse and emerging managers, dispels both notions and proves there is a strong economic rationale to leaning in here. It’s not just feel-good investing. It’s creating alpha.

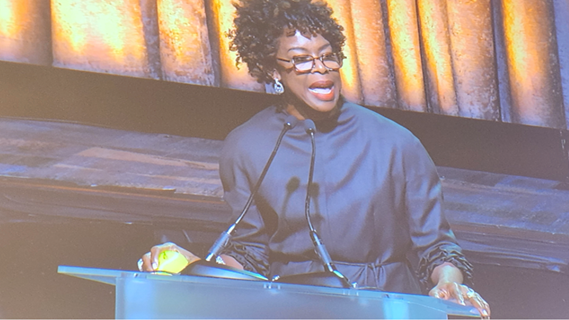

Even so, building such an ecosystem doesn’t happen overnight. That’s where Renae Griffin comes in. Ms. Griffin founded the Consortium twenty years ago with two simple goals in mind: to help institutional capital allocators connect to invest more deliberately in diverse sponsors, and help diverse sponsors connect with these capital allocators to accelerate their growth.

As someone who started his career in finance twenty years ago, I can fully appreciate just how revolutionary an event like Consortium would have been when it was originally launched. Back then, the importance of diversity and inclusion was still being openly questioned, not just in finance but nationally. Most efforts were still centered around increasing minority representation in corporate America via job readiness and placement programs like INROADS and SEO (I participated in and benefited greatly from both). There were very few people of color at that time that had made the leap to launching successful stand-alone, institutionally backed investment firms. The late, great Reginald Lewis famed author of classic “Why Should White Guys Have All the Fun?” was one of them, inspiring young banking analysts like me to dream bigger.

And so, Ms. Griffin helped create a bridge to uplifting the next crop of Reginald Lewis’. Though initially her concern was whether people would even show up, it became clear very quickly not would they do so, but also keep coming back. From what in Ms. Griffin’s own words was a humble first year with less than 50 attendees, I found myself sitting in a banquet hall with 15x that number, from pension fund managers to real estate developers, a testament to a shared recognition amongst industry participants this had become a learning lab and ecosystem of the highest order. Even though twenty years have passed, there are shockingly few forums where asset allocators or asset managers can connect, strategize, and collaborate around how to accelerate the path of fund formation for emerging GPs, all while offering GPs direct access to relationships that can ultimately evolve into LP investments.

Like any successful initiative, the Consortium’s mission and event has had to grow with the times. In addition to incubating the forward pipeline of emerging managers, discussions were very much oriented around how diverse managers that are already established can accelerate their AUM growth, and graduate beyond simply being lumped into a “diverse” or “impact-oriented” bucket as they diversify their capital base. Unfortunately, there are still substantial structural impediments blocking access to capital for minorities, women, and other groups. Despite this, the great success of several attendees in the room should be a homing beacon, reinforcing the point that raising institutional capital is difficult but not an impossibility. I fully expect attendance to be even higher next year.

Two decades into the journey, Ms. Griffin reflected on what made her most proud about Consortium. “I think I am most proud of the young people that I am seeing that are coming into the space that have hope. And if Consortium could be a walkway they could take to see opportunities in this space, if it has been a catalyst for some capital flows to increase, and we create that opening, that pathway to them, to me that’s what I would be most proud of.”

With Ms. Griffin at the helm, I have no doubt Consortium will continue to do just that.

Written by Vernon Beckford at [email protected]